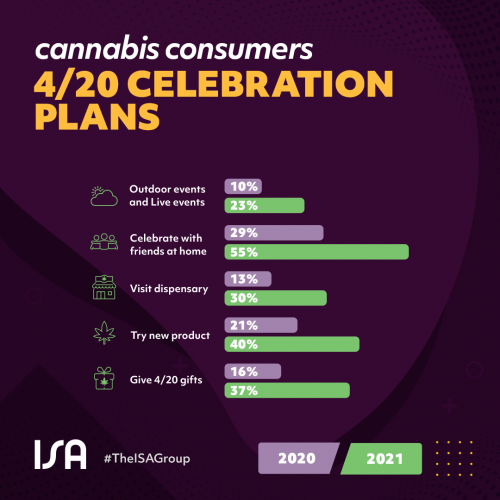

Poll results from ISA indicate significant boosts in dispensary visits, gifting and trying new products for 4/20/2021

There’s a dramatic shift in the way cannabis consumers across the U.S. will be celebrating the 4/20 cannabis holiday this year, according to poll results from insights firm ISA, a Material Company. This year more consumers plan to host friends at home, visit dispensaries and celebrate in public places, such as live events or restaurants. This comparison is based on survey results from another ISA study fielded in April of 2020.

The percentage of cannabis consumers who say they will celebrate the holiday in some way has now outpaced pre-COVID-19 levels. In 2019, 70% of cannabis consumers said they would celebrate the 4/20 holiday. That percentage has jumped to 78% in 2021.

The most significant variance from 2020 poll results has been among people who say they are planning to celebrate 4/20 with friends at home. In 2019, before the pandemic, 58% of consumers who planned to participate in the holiday said they would celebrate at home with friends. That number dipped to 29% in April of 2020, and has now rebounded to 55%, indicating a return to normalcy for cannabis consumers who celebrate by hosting private events.

The findings could indicate the cannabis industry will experience a significant uptick in sales on and around April 20th, with more people venturing out to their local dispensary. The percentage of cannabis consumers who say they will visit a dispensary to celebrate 4/20 rose from 13% in 2020 to 30% in 2021, coming in slightly above the 2019 percentage of 26%. Additionally, more consumers plan to purchase 4/20 gifts for friends and family in 2021, compared to 2020. The 2021 poll revealed that 37% of consumers who celebrate 4/20 plan to buy gifts for others, while 16% reported doing so in 2020. Another positive sign for dispensaries and cannabis brands is that a significant number of consumers (40%) are planning to try a new product as part of their holiday celebration, up from 21% in 2020.

“The cannabis industry grew steadily throughout the pandemic,” said Adriana Hemans, ISA’s VP of Demand. “What’s exciting about the early poll results from 2021 is that cannabis consumers are coming together again for 4/20, seeking novel experiences with new products. Those products could potentially become part of their regular cannabis routines, providing additional growth opportunities for brands.” ISA will continue to gather data and insights from cannabis consumers in the days leading up to April 20th, providing business analysts, industry experts and media outlets with ongoing updates on consumer behaviors related to the 4/20 holiday. Figures presented in this press release are based on three studies – a nationwide poll of 1,001 cannabis consumers fielded April 26th through April 29th of 2019, with a 3% margin of error at a 95% level of confidence; a nationwide poll of 420 cannabis consumers fielded April 18th through April 20th of 2020, with a 5% margin of error at a 95% level of confidence, and a nationwide poll of 420 cannabis consumers with a 5% margin of error at a 95% level of confidence. To qualify for inclusion in all of these studies, participants indicated that they are over 21 years old and had purchased or consumed cannabis in the last 90 days. Participants in the 2021 study were gathered through ISA’s proprietary cannabis research panel – The Green Time.